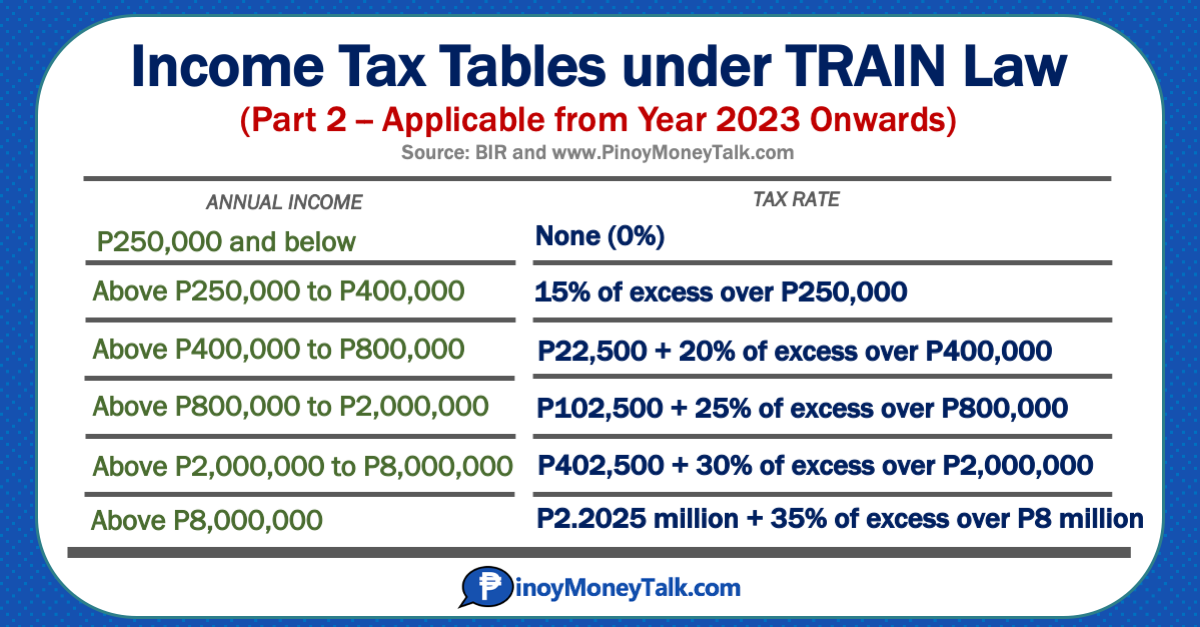

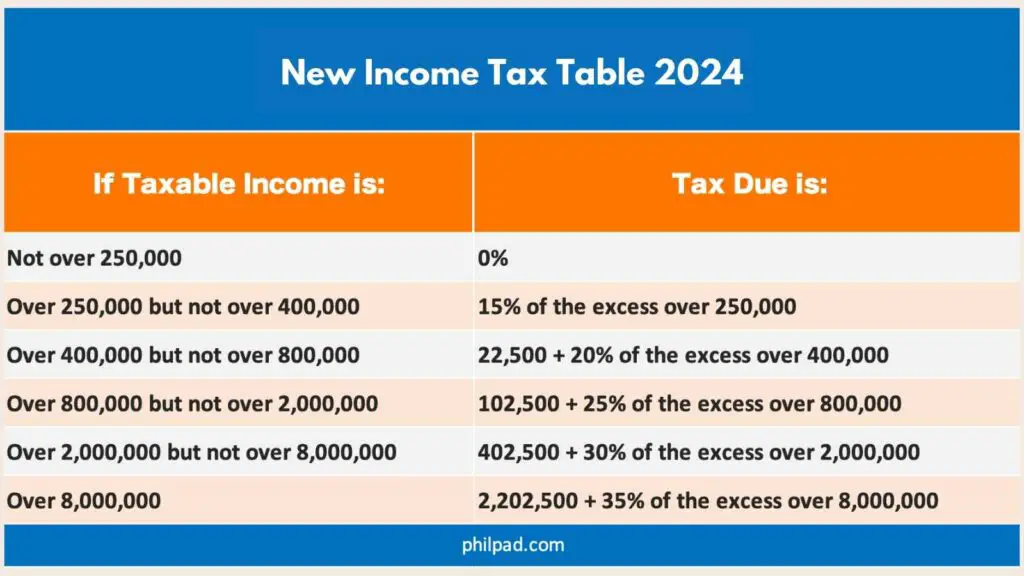

Corporate Tax Rate 2025 Philippines 20%. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. One of the significant reforms under the create act is the lowering of the corporate income tax rate from 30%, previously the highest.

On 9 september 2025, the philippine senate approved the corporate recovery and tax incentives for enterprises to maximize opportunities for reinvigorating the economy (create. *with net taxable income not exceeding.

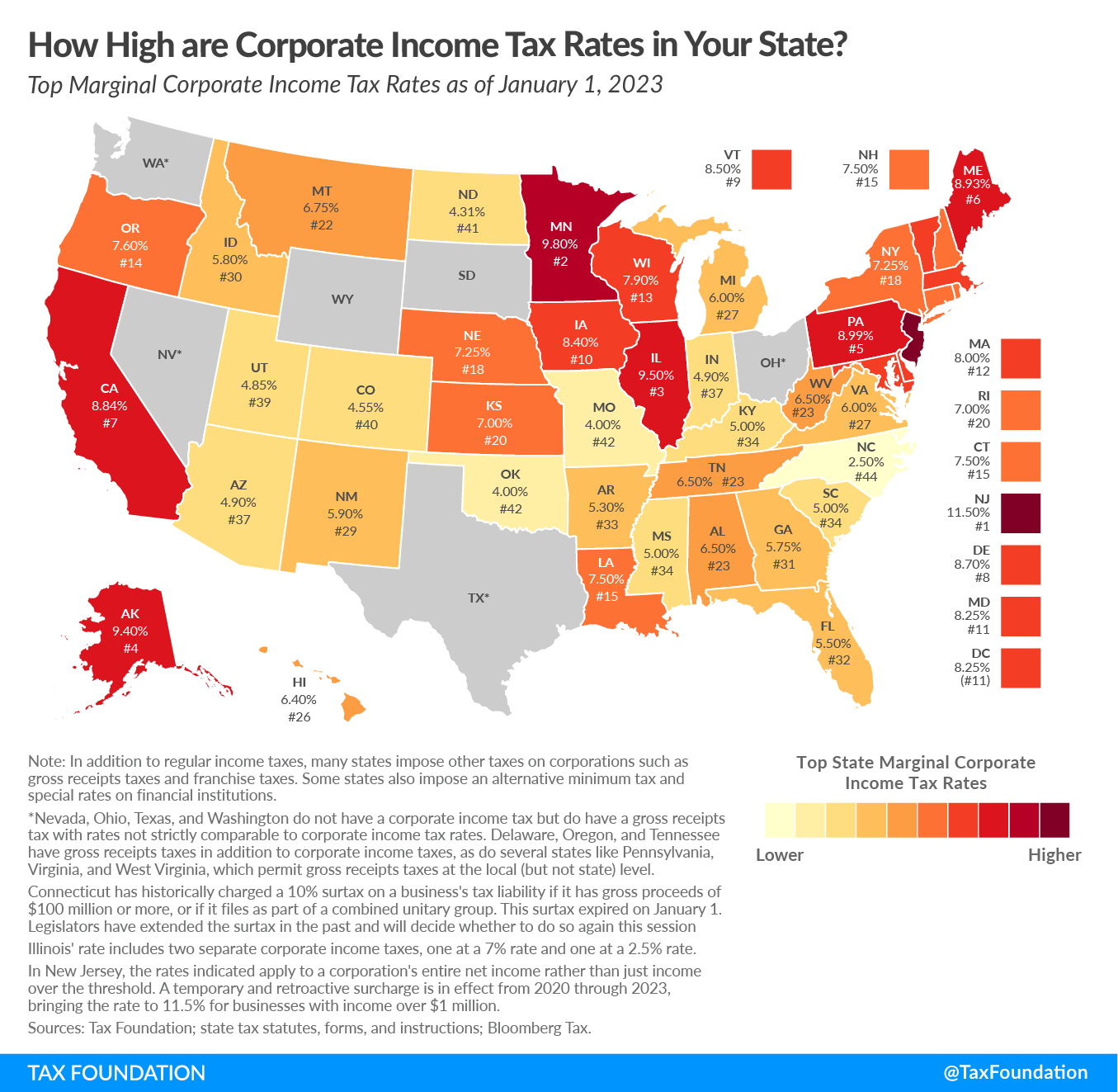

Iowa Will Have a Lower Corporate Tax Rate in 2025 ITR Foundation, This tax alert is issued to inform all concerned on the applicable mcit rate for the accounting periods ending from july 31, 2025 to june 30, 2025, pursuant to republic act no.

Tax Return Deadline 2025 Philippines Letta Olimpia, 11534, otherwise known as the corporate recovery and tax incentives for enterprises act (create), has resulted to a myriad of changes in corporate tax rules such as the reduction of.

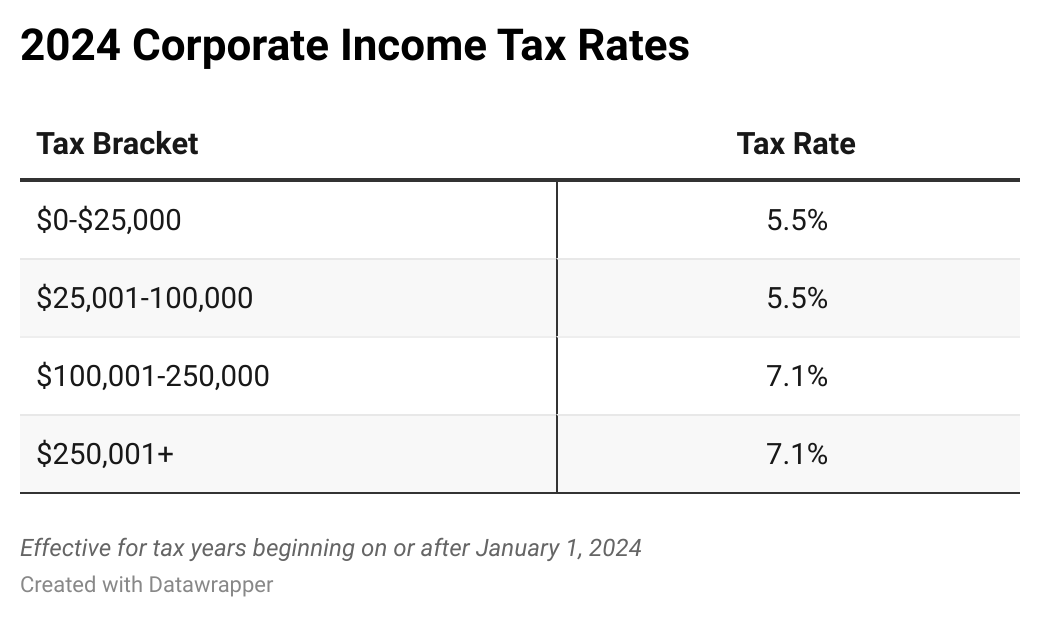

Combined State and Federal Corporate Tax Rates in 2025, Interest expense should be reduced by an amount equivalent to 20% of interest income subjected to final tax unless domestic corporations using 20% income tax rate in which case.

2025 State Corporate Tax Rates & Brackets American Legal Journal, Effective 1 july 2025, the corporate income tax (cit) rate is reduced from 30% to:

New Tax Tables 2025 Philippines Freida Melita, On 9 september 2025, the philippine senate approved the corporate recovery and tax incentives for enterprises to maximize opportunities for reinvigorating the economy (create.

Tax rates for the 2025 year of assessment Just One Lap, Thailand, indonesia and the philippines announce interest rate decisions.

State Corporate Tax Rates and Brackets for 2025 CashReview, Kpmg’s corporate tax table provides a view of corporate tax rates around the world.

Biden Wants To Raise The Minimum Corporate Tax Rate By A Whopping 40, Corporate taxpayers can avail themselves of the optional standard deduction computed at 40% of gross income.

Latest BIR Tax Rates 2025 Philippines Life Guide PH, Thailand and indonesia are forecast to hold at 2.5 per cent and 6 per cent,.

Corporate Tax Rate 2025 Philippines 20 Anya Malory, 20% for domestic corporations with net taxable income not exceeding php5 million (us$100,000) and.