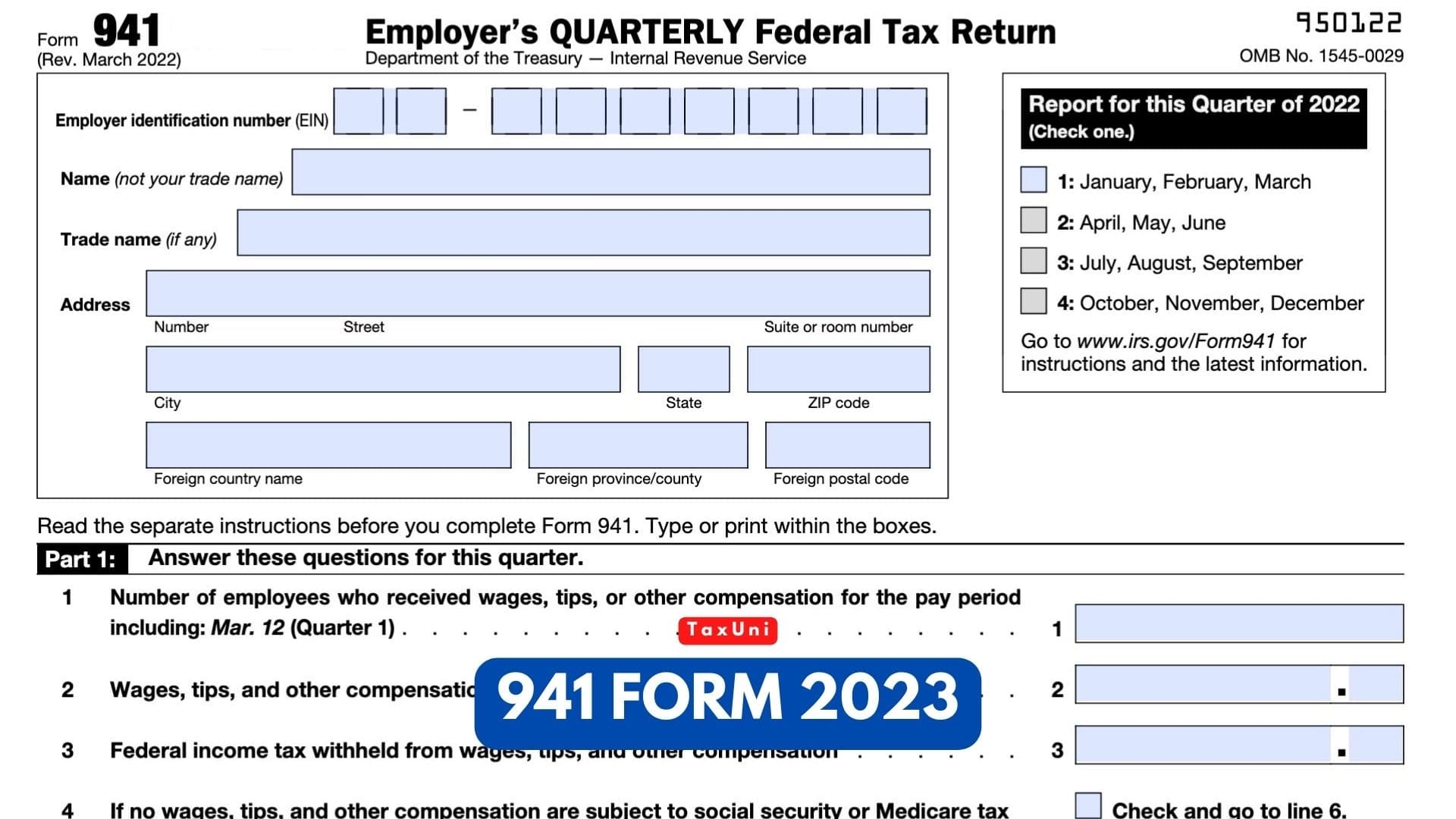

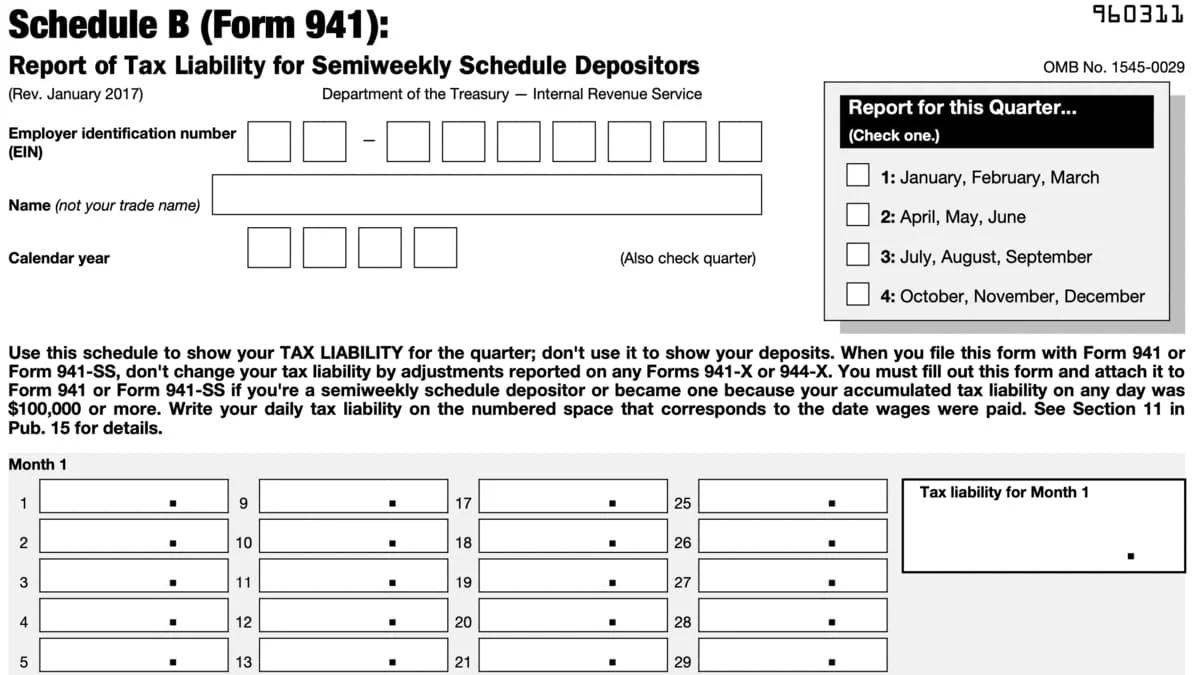

Irs 2025 Form 941. Employers use this form to report income taxes, social security tax or. To determine if you’re a semiweekly schedule depositor, see section 11 of pub.

Irs form 941, also known as the employer’s quarterly federal tax return, is used when businesses report the income taxes, payroll taxes, social security, and medicare. Once the program opens in 2025, go to the irs free file to start your federal return.

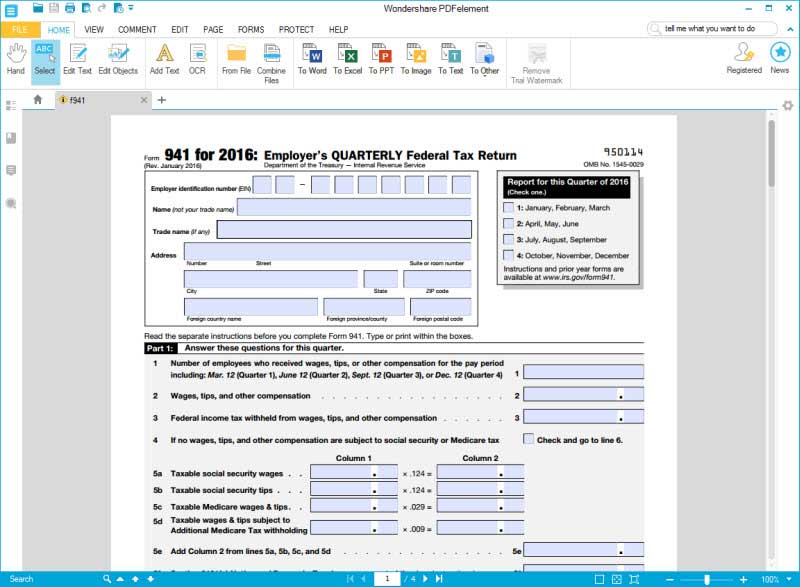

941 Form 2025 Pdf Filler Ginni Justine, Tax year 2025 guide to the employer's quarterly federal tax form 941.

Irs Form 941 Due Dates 2025 Moina Terrijo, Pay your balance or make estimated tax payments with direct pay.

IRS Form 941 Schedule B 2025, And schedule r, allocation schedule for aggregate form 941 filers, along with.

Irs Form 941 For 2025 Pdf Fayre Roseanna, The revision is planned to be used for all four quarters.

Irs Gov Form Printable Form 941 2025 Adrea Ardella, General rules and specifications for substitute form 941, schedule b (form 941), schedule d (form 941), and schedule r (form 941) mar 2025 03/28/2025

Irs Form 941 2025 Form B Adria Ardelle, Irs form 941 is used by employers to report income, and fica taxes withheld from employees' paychecks.

2025 Form 941 Instructions Addie Anstice, Form 941 reports federal income and fica taxes each quarter.

Irs 941 Form 2025 Fillable Pdf Nat Sashenka, It includes income tax, social security, and medicare withholdings.

941 Form For 2025 Jemmie Melloney, The irs released the 2025 form 941, employer’s quarterly federal tax return;